What Are Property Taxes In San Bernardino County . the average effective property tax rate in san bernardino county is 0.90%. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). Free echeck (electronic check) is a digital version of the paper check. Establishing an assessed value for all. Santa clara county the median home value in santa clara county is. pay your property taxes conveniently and securely using our website. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median.

from www.land.com

the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). Establishing an assessed value for all. Santa clara county the median home value in santa clara county is. Free echeck (electronic check) is a digital version of the paper check. pay your property taxes conveniently and securely using our website. the average effective property tax rate in san bernardino county is 0.90%.

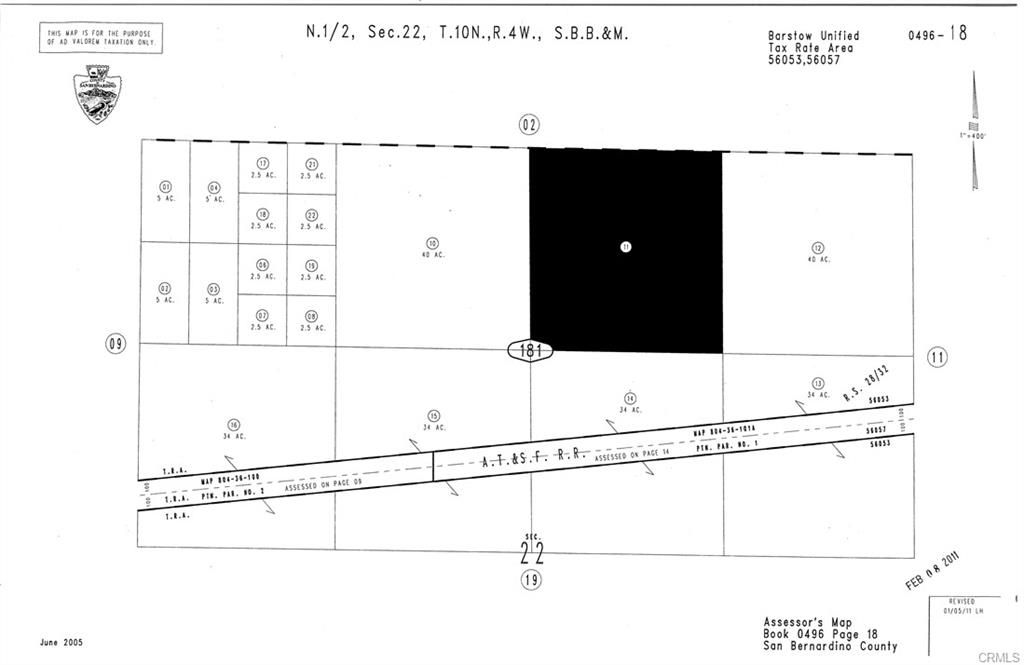

40 acres in San Bernardino County, California

What Are Property Taxes In San Bernardino County Santa clara county the median home value in santa clara county is. Santa clara county the median home value in santa clara county is. Establishing an assessed value for all. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. the average effective property tax rate in san bernardino county is 0.90%. Free echeck (electronic check) is a digital version of the paper check. pay your property taxes conveniently and securely using our website. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%).

From www.printableaffidavitform.com

Tax Affidavit Form For San Bernardino County 2024 What Are Property Taxes In San Bernardino County Santa clara county the median home value in santa clara county is. pay your property taxes conveniently and securely using our website. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00. What Are Property Taxes In San Bernardino County.

From giooinzqc.blob.core.windows.net

San Bernardino County Real Estate Transfer Tax at Allen blog What Are Property Taxes In San Bernardino County the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. pay your property taxes conveniently and securely using our website. the average effective property tax rate in san bernardino county is 0.90%. the assessor is responsible for locating, describing, and identifying ownership of all. What Are Property Taxes In San Bernardino County.

From www.land.com

80 acres in San Bernardino County, California What Are Property Taxes In San Bernardino County the average effective property tax rate in san bernardino county is 0.90%. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the assessor is responsible for. What Are Property Taxes In San Bernardino County.

From hxepdrcti.blob.core.windows.net

Property Tax San Luis Obispo County at Colleen McClure blog What Are Property Taxes In San Bernardino County Free echeck (electronic check) is a digital version of the paper check. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the average effective property tax rate in san bernardino county is 0.90%. our san bernardino county property tax calculator can estimate your property taxes based on similar properties,. What Are Property Taxes In San Bernardino County.

From www.pdffiller.com

Preliminary Change Of Ownership Report San Bernardino Fill Online What Are Property Taxes In San Bernardino County our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. pay your property taxes conveniently and securely using our website. Free echeck (electronic check) is a digital version of the paper check. Santa clara county the median home value in santa clara county is. Establishing an assessed value for. What Are Property Taxes In San Bernardino County.

From freeprintableaz.com

San Bernardino County (California, United States Of America San What Are Property Taxes In San Bernardino County Santa clara county the median home value in santa clara county is. Establishing an assessed value for all. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. Free echeck (electronic check). What Are Property Taxes In San Bernardino County.

From siteselection.com

Investment Profile San Bernardino County, California How the Good What Are Property Taxes In San Bernardino County pay your property taxes conveniently and securely using our website. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. Free echeck (electronic check) is a digital version of the paper check. our san bernardino county property tax calculator can estimate your property taxes based. What Are Property Taxes In San Bernardino County.

From www.socalvahomes.org

VA Loan Limits in San Bernardino County for 2024 SoCal VA Homes What Are Property Taxes In San Bernardino County our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. Establishing an assessed value for all. pay your property taxes conveniently and securely using our website. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Santa clara county. What Are Property Taxes In San Bernardino County.

From www.land.com

40 acres in San Bernardino County, California What Are Property Taxes In San Bernardino County the average effective property tax rate in san bernardino county is 0.90%. the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. Santa clara county the median home value in santa clara county is. san bernardino county (0.72%) has a 1.4% higher property tax rate. What Are Property Taxes In San Bernardino County.

From lao.ca.gov

Understanding California’s Property Taxes What Are Property Taxes In San Bernardino County Santa clara county the median home value in santa clara county is. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). Establishing an assessed value for all. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the assessor is. What Are Property Taxes In San Bernardino County.

From exocwzzlr.blob.core.windows.net

San Bernardino County Assessor Property Search at Dora Roselli blog What Are Property Taxes In San Bernardino County san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the average effective property tax rate in san bernardino county is 0.90%. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; our san bernardino county property tax calculator can. What Are Property Taxes In San Bernardino County.

From www.financestrategists.com

Find the Best Tax Preparation Services in San Bernardino County, CA What Are Property Taxes In San Bernardino County pay your property taxes conveniently and securely using our website. the assessor is responsible for locating, describing, and identifying ownership of all property within the county of san bernardino; Establishing an assessed value for all. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. Santa clara county. What Are Property Taxes In San Bernardino County.

From www.sbsun.com

San Bernardino County’s typical property tax bill runs 4.4 below U.S What Are Property Taxes In San Bernardino County Free echeck (electronic check) is a digital version of the paper check. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the average effective property tax rate in san bernardino county is 0.90%. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average. What Are Property Taxes In San Bernardino County.

From andersonadvisors.com

San Bernardino County Property Tax Assessor and Tax Collector What Are Property Taxes In San Bernardino County pay your property taxes conveniently and securely using our website. Santa clara county the median home value in santa clara county is. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the average effective property tax rate in san bernardino county is 0.90%. the assessor is responsible for. What Are Property Taxes In San Bernardino County.

From www.neilsberg.com

San Bernardino County, CA Median Household 2024 Update Neilsberg What Are Property Taxes In San Bernardino County the median property tax (also known as real estate tax) in san bernardino county is $1,997.00 per year, based on a median. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the average effective property tax rate in san bernardino county is 0.90%. Santa clara county the median home. What Are Property Taxes In San Bernardino County.

From www.vvng.com

San Bernardino County officials warn homeowners of real estate scam What Are Property Taxes In San Bernardino County Free echeck (electronic check) is a digital version of the paper check. san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. the average effective property tax rate in san bernardino. What Are Property Taxes In San Bernardino County.

From www.pressenterprise.com

SAN BERNARDINO Taxdelinquent property to be auctioned off Press What Are Property Taxes In San Bernardino County san bernardino county (0.72%) has a 1.4% higher property tax rate than the average of california (0.71%). the average effective property tax rate in san bernardino county is 0.90%. our san bernardino county property tax calculator can estimate your property taxes based on similar properties, and show you. Santa clara county the median home value in santa. What Are Property Taxes In San Bernardino County.

From www.land.com

10 acres in San Bernardino County, California What Are Property Taxes In San Bernardino County pay your property taxes conveniently and securely using our website. Santa clara county the median home value in santa clara county is. Free echeck (electronic check) is a digital version of the paper check. the average effective property tax rate in san bernardino county is 0.90%. Establishing an assessed value for all. the median property tax (also. What Are Property Taxes In San Bernardino County.